Where’s the Crisis?

January 8, 2018

“There was no crisis, so no need for FERC action” goes the mantra last week from renewable fuel advocates. The roof didn’t fall in, the gun wasn’t loaded, the rope didn’t snap, so go back to sleep. This is the head-in-the-sand logic of complacent dogmatists.

The implication is that nothing less than a massive blackout would have persuaded Energy Secretary Perry’s critics to acknowledge the need for change. Only if the continental U.S. became post-hurricane Puerto Rico would they grudgingly agree Perry was on to something, that conventional grid management practices must adjust to dramatic reductions in baseload power.

This past week should be instructive. Coal demand surpassed previous one-day records, supplying on average 39 percent of the power from five ISOs, with gas contributing 22 percent, nuclear 20 percent and hydro & wind combining for 8 percent. That’s the same coal-generated power that is at risk if plants continue to close at their expected rate.

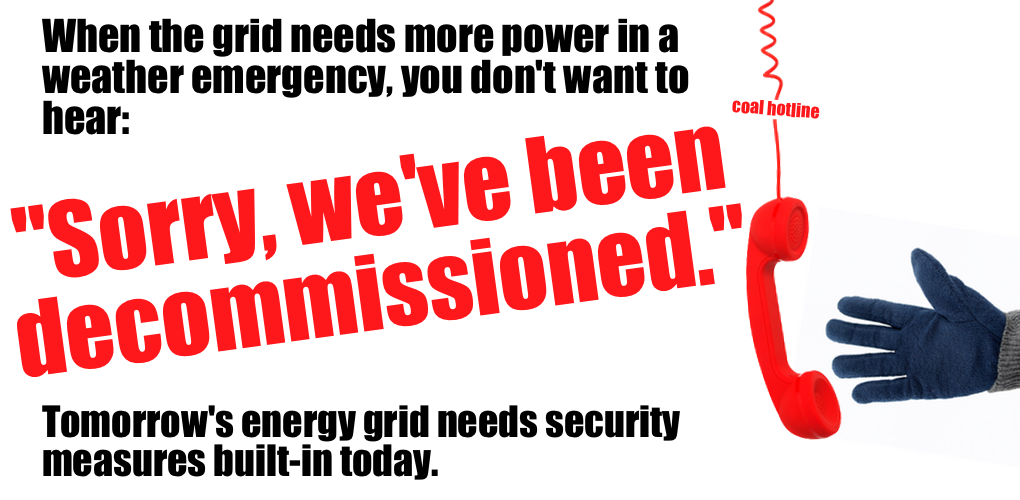

The DOE staff report forecasts that between 2017 and ’22, 37,000 MW of additional coal capacity will be retired; FERC forecasts 20,000 MW of that will be gone by 2020. Nuclear capacity will drop by 3,000 MW between 2019-’20 and lose 100 GW by 2040. Soon there may be just a decommissioned coal plant at the other end of the emergency line. It shouldn’t take a stable genius to see that tomorrow’s grid requires security measures that ought to be implemented today.

Midwest and Eastern RTOs survived Vortex 2.0 with the incremental reforms they implemented in 2015. But only after transmission lines and oil supplies were stretched to breaking, nuclear capacity unexpectedly fell out of the system and natural gas prices soared.

Policymakers should be looking past today to consider tomorrow. Will natural gas bear the increasing burden from further baseload retirements? Will projected LNG exports draw supplies we count on now? Can essential transmission infrastructure survive aggressive opposition from activists? Will renewable fuels sustain their torrid pace when taxpayers are no longer forced to subsidize producers, if tariffs slow imported technology, and investment continues its sharp decline?

Maybe. But the point is we don’t know.

Reasonable people can dispute the answers, but they should pose the questions. The same crowd that ignores the amber lights now flashing on the dashboard enthusiastically backed the past administration’s policies that created this concern in the first place.

No surprise they now ask: where is the crisis?

- On January 8, 2018