28Sep

Energy Supply for Our Citizens Must Transcend Politics

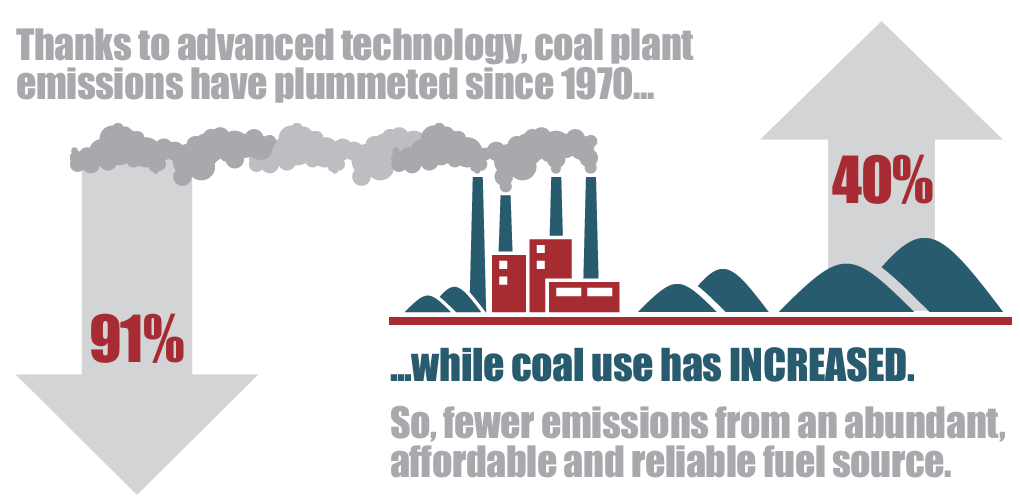

Via The Morning Consult: The number of coal and nuclear power plants that have closed in recent years could power tens of millions of homes. In April, Energy Secretary Rick Perry asked for a report on whether continued closures pose a threat, and whether the markets are adequately compensating the resilience benefits these “baseload” or […]

- On September 28, 2017 Read More